ITR:Complete guide on how to e-file ITR (Income Tax Returns) on the Income Tax Department Portal

September 18, 2019

A taxpayer may want to file his income tax return for reporting his income for a financial year, carrying forward losses, claiming an income tax refund etc. An income tax return is a form which enables a taxpayer to declare his income, expenses, tax deductions, investments, taxes etc. The Income Tax Act, 1961 makes it mandatory under various scenarios for a taxpayer to file an income tax return.

The Income Tax Department provides the facility for electronic filing (e-filing) of an income tax return. Before discussing the steps involved in the e-filing of income tax return, it is essential for a taxpayer to have the necessary documents at the ready.

The steps involved in the filing of an income tax return are:

- Calculation of Income and Tax

- Tax Deducted at Source (TDS) certificates and Form 26AS

- Choose the right Income Tax Form

- Download ITR utility from income tax portal

- Fill in your details in the downloaded file

- Validate the information entered

- Convert the file to XML format

- Upload the XML file on the income tax portal and filing

1. Calculation of Income and Tax?

The taxpayer will be required to calculate his/her income as per the income tax law provisions applicable to him/her.

2. Tax Deducted at Source (TDS) certificates and Form 26AS

The taxpayer should summarise his TDS amount from the TDS certificates received by him for all the 4 quarters of the financial year. Form 26AS helps the taxpayer in summarising the same.

3. Choose the right Income Tax Form

The taxpayer has to ascertain the income tax form/ITR Form applicable for filing his income tax return. After ascertaining the income tax form, the taxpayer can proceed with the filing of the income tax return.

There are 2 modes available for filing–online and offline. The online mode is available only for ITR 1 and ITR 4; it is not available for forms of other categories of individual taxpayers. The offline mode (generating XML and uploading) is available for all types of income tax forms.

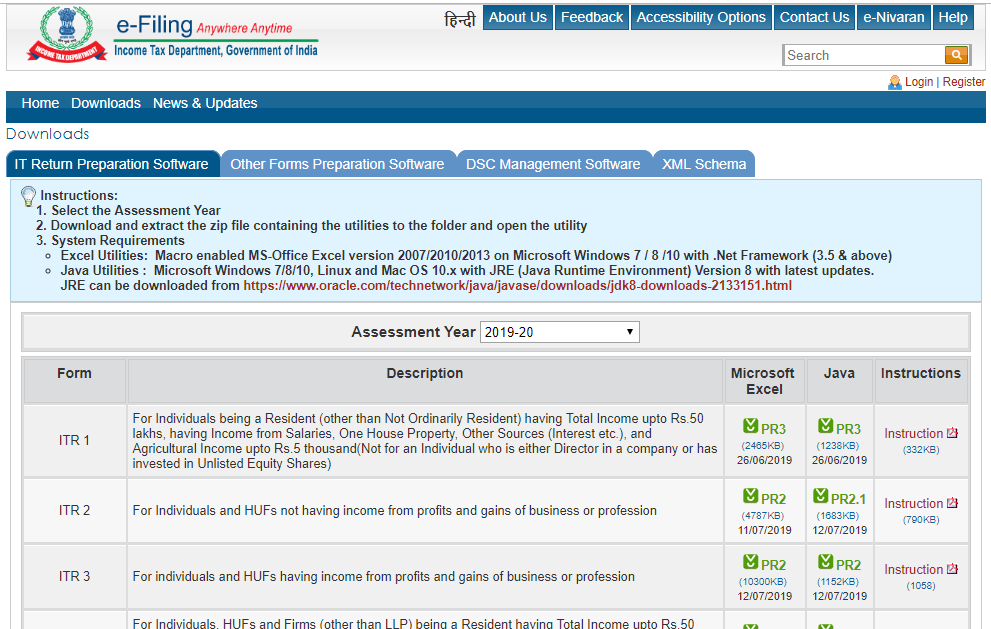

4. Download ITR utility from income tax portal

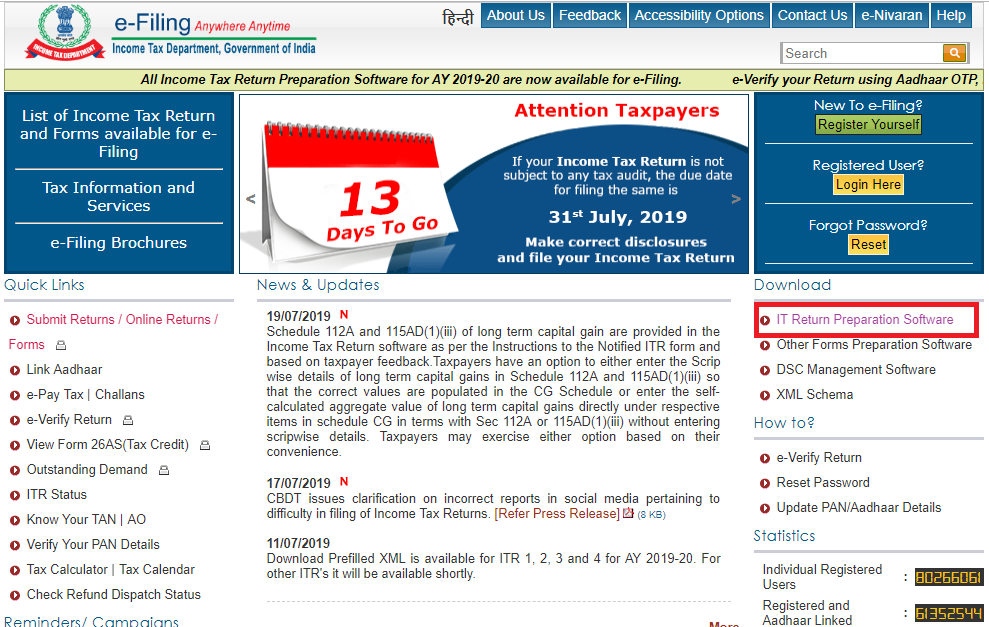

Visit the site www.incometaxindiaefiling.gov.in and click on ‘IT Return Preparation Software’ option on the right menu.

5. Fill in your details in the downloaded file

Upon downloading the offline utility, fill in the relevant details of your income, and check the tax payable or the refund receivable as per the calculations of the utility. The details of income tax challan can be filled in the downloaded form.

6. Validate the information entered

You can see a few buttons on the right-hand side of the downloaded form. Click on the ‘Validate’ button to ensure all the required information is filled.

7. Convert the file to XML format

Upon successfully validating, click on the ‘Generate XML’ button on the right-hand side of the file to convert the file into XML file format.

8. Upload the XML file on the income tax portal

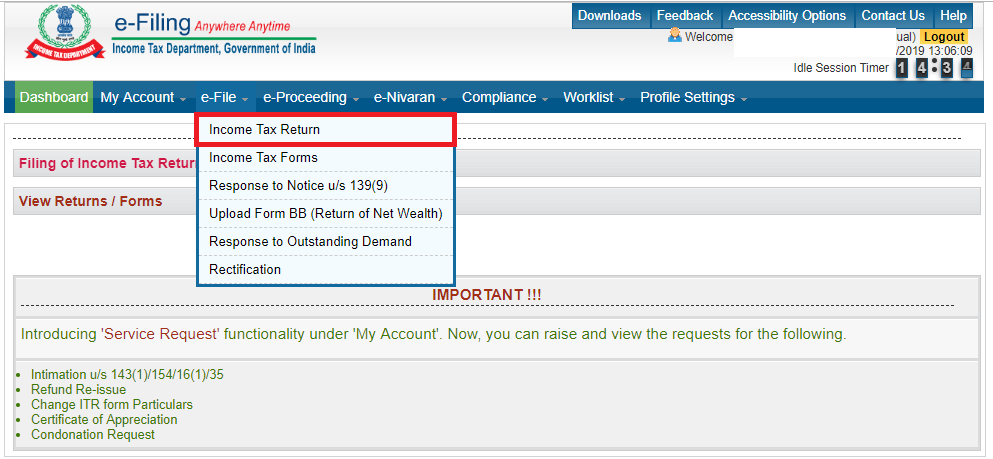

Now, log in to the income tax e-filing portal and click on the ‘e-File’ tab to select the ‘Income Tax Return’ option.

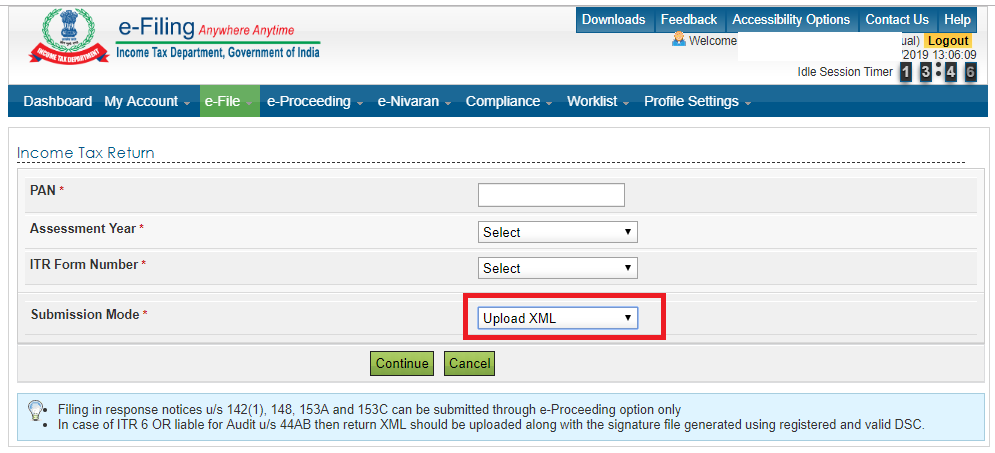

Provide the necessary details such as PAN, assessment year, ITR form number, and the submission mode. Remember to choose the option ‘Upload XML’ from the drop down corresponding to the field name ‘Submission Mode’ as given in the image below.

Now, attach the XML file from your computer and click on the ‘Submit’ button. Choose one of the available verification modes—Aadhaar OTP, electronic verification code (EVC), or sending manually signed copy of ITR-V to CPC, Bengaluru.