TYPES OF COMPANY ACCORDING TO COMPANIES ACT, 2013

December 4, 2019

INTRODUCTION

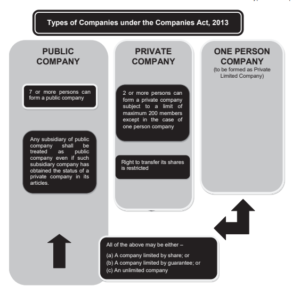

The Companies Act, 2013 provides for the kinds of companies that can be promoted and registered under the

Act. The three basic types of companies which may be registered under the Act are:

- Private Companies;

- Public Companies; and

- One Person Company (to be formed as Private Limited Company)

Section 3 of the Companies Act 2013, states that

(1) A company may be formed for any lawful purpose by–

- seven or more persons, where the company to be formed is a public company;

- two or more persons, where the company to be formed is a private company; or

- one person, where the company to be formed is a One Person Company that is to say, a privatecompany,

by subscribing their names or his/her name to a memorandum and complying with the requirements of this act in respect of registration.

Provided that the memorandum of One Person Company shall indicate the name of the other person, with his prior written consent in the prescribed form, who shall, in the event of the subscriber’s death or his incapacity to contract become the member of the company and the written consent of such person shall also be filed with the Registrar at the time of incorporation of the One Person Company along with its memorandum and articles:

Provided further that such other person may withdraw his consent in such manner as may be prescribed:

Provided also that the member of One Person Company may at any time change the name of such other person by giving notice in such manner as may be prescribed:

Provided also that it shall be the duty of the member of One Person Company to intimate the company the change, if any, in the name of the other person nominated by him by indicating in the memorandum or otherwise within such time and in such manner as may be prescribed, and the company shall intimatethe Registrar any such change within such time and in such manner as may be prescribed:

Provided also that any such change in the name of the person shall not be deemed to be an alteration of the memorandum.

(2) A company formed under sub-section (1) may be either–

- a company limited by shares; or

- a company limited by guarantee; or

- an unlimited company

PRIVATE COMPANY

As per Section 2(68) of the Companies Act, 2013, “private company” means a company having a minimum paid-up share capital as may be prescribed, and which by its articles,–

- restricts the right to transfer its shares;

- except in case of One Person Company, limits the number of its members to two hundred:

Provided that where two or more persons hold one or more shares in a company jointly, they shall, forthe purposes of this clause, be treated as a single member

Provided further that the following persons shall not be included in the number of members;–

- persons who are in the employment of the company; and

- persons who, having been formerly in the employment of the company, were members of the company while in that employment and have continued to be members after the employment ceased,

shall not be included in the number of members; and

- prohibits any invitation to the public to subscribe for any securities of the company;

It must be noted that it is only the number of members that is limited to two hundred. A private company may issue debentures to any number of persons, the only condition being that an invitation to the public to subscribe for debentures is prohibited.

The aforesaid definition of private limited company specifies the restrictions, limitations and prohibitions, which must be expressly provided in the articles of association of a private limited company.

As per proviso to Section 14 (1) of the Act, if a company being a private company alters its articles in such a manner that they no longer include the restrictions and limitations which are required to be included in the articles of a private company under this Act, such company shall, as from the date of such alteration, cease to be a private company.

A private company can only accept deposit from its member’s upto a particular limit in accordance with section 73 of the Companies Act, 2013.

The words ‘Private Limited’ must be added at the end of its name by a private limited company.

As per section 3(1), a private company may be formed for any lawful purpose by two or more persons, by subscribing their names to a memorandum and complying with the requirements of this Act in respect of registration. Section 149(1) further lays down that a private company shall have a minimum number of two directors. The only two members may also be the two directors of the private company.

Characteristics of Private Limited Company

- Members– To start a company, minimum number of 2 members is required and a maximum number of 200 members as per the provisions of the Companies Act, 2013.

- Limited Liability– The liability of each member or shareholders is limited. It means that if a company faces loss under any circumstances then its shareholders are not liable to sell their own assets for payment. Thus, the personal, individual assets of the shareholders are not at risk.

- Perpetual succession– The company keeps on existing in the eyes of law even in the case of death, insolvency, the bankruptcy of any of its members. This leads to perpetual succession of the company. The life of the company keeps on existing forever.

- Index of members– A private company has a privilege over the public company as they don’t have to keep an index of its members since the number of members is less than 50 generally in these companies whereas the public company is required to maintain an index of its members, as generally such companies have the number of members in hundreds and thousands and so on. In short, the maintenance of index is not necessary where the number of members is less than fifty.

- A number of directors– When it comes to directors, a private company needs to have only two directors. With the existence of 2 directors, a private company can come into existence and can start with its operations.

- Paid up capital– There is no minimum capital requirement. Prospectus– Prospectus is a detailed statement of the company affairs which is issued by a company for its public. However, in the case of private limited company, there is no such need to issue a prospectus because in this type of companies, public is not invited to subscribe for the shares of the company.

- Minimum subscription– It is the amount to be received by the company on the shares to be issued within a certain period of time. If the company is not able to receive such amount then they cannot commence further business. In case of private limited company shares can be allotted without receiving the amount of such minimum subscription since such amount is required to be stated in the prospectus which is not applicable and required in the case of private companies.

- Name– It is mandatory for all the private companies to use the word “private limited” after its name.

PUBLIC COMPANY

By virtue of Section 2(71), a public company means a company which:

- is not a private company; and

- has a minimum paid-up share capital, as may be prescribed

Provided that a company which is a subsidiary of a company, not being a private company, shall be deemed to be public company for the purposes of this Act even where such subsidiary company continues to be a private company in its articles.

As per section 3(1)(a), a public company may be formed for any lawful purpose by seven or more persons, by subscribing their names or his name to a memorandum and complying with the requirements of this act in respect of registration. A public company may be said to be an association consisting of not less than 7 members, which is registered under the Act. In principle, any member of the public who is willing to pay the price may acquire shares in or debentures of it. The securities of a public company may be quoted on a Stock Exchange. The number of members is not limited to two hundred.

As per section 58(2), the securities or other interest of any member in a public company shall be freely transferable. However, any contract or arrangement between two or more persons in respect of transfer of securities shall be enforceable as a contract.

The Companies Act, makes a clear distinction in regard to the transferability of shares relating to private and public companies. By definition, a “private company” is a company which restricts the right to transfer its shares. In the case of a public company, the Act provides that the shares or debentures and any interest therein, of a company, shall be freely transferable.

The provision contained in the law for the free transferability of shares in a public company is founded on the principle that members of the public must have the freedom to purchase and, every shareholder should have the freedom to transfer. The incorporation of a company in the public, as distinguished from the private, realm leads to specific consequences and the imposition of obligations envisaged in law. Those who promote and manage public companies assume those obligations. Corresponding to those obligations there are some rights, which the law recognizes as inherent in the members of the public who subscribe to shares of the company.

CHARACTERISTICS OF PUBLIC COMPANY

- Board of Directors– Public limited companies are headed by a board of directors. Composition of the board of directors is set out in the company’s articles of association. Normally it comprises of a minimum number of three members and a maximum of 15. The company may appoint more than 15 directors after passing a special resolution. These are elected by the shareholders during the annual general meeting. They act as the representatives of the shareholders in the management of the company.

- Limited Liability Shareholder- liability for the losses of the company is limited to their share contribution only. This is what makes it a separate legal entity from its shareholders. The business can be sued on its own and not involve its shareholders. The company does not belong to any person since one person can own only a part of it.

- Number of Members– A public limited company has a minimum number of seven shareholders or members and a limitless number of members. It can have as many shareholders as its share capital can accommodate.

- Transferable shares- Shares of a public limited company are bought and sold in a stock exchange market. They are freely transferable between its members and people trading in the stock exchange.

- Life Span- A public limited company is not affected by death of one of its shareholders, but the shares are transferred to the next kin or legal heir of such deceased shareholder and the company continues to run its business as usual. In the case of a director’s death, the Board is empowered to fill the resulting casual vacancy may be filled by Board of Directors at Board meeting which shall be subsequently approved by members in the immediate next general meeting.

- Financial Privacy– Public limited companies are strictly regulated and are required by law to publish their complete financial statements annually. This ensures that they reveal their true financial position to their owners and to potential investors so that they can determine the true worth of its shares.

- Capital- Public limited companies enjoy an increased ability to raise capital since they can issue shares to the public through the stock market. They can also raise additional capital by issuing debentures and bonds through the same market from the public. Debentures and bonds are in the form of secured or unsecured debts issued to a company on the strength of its integrity and financial performance by the general public or its members etc

ONE PERSON COMPANY (OPC)

With the implementation of the Companies Act, 2013, a single person could constitute a Company, under the One Person Company (OPC) concept. The introduction of OPC in the legal system is a move that would encourage corporatization of micro businesses and entrepreneurships.

OPC is a one shareholder corporate entity, where legal and financial liability is limited to the company only.

As per section 2(62) of the Companies Act, 2013, “One Person Company” means a company which has only one person as a member. Section 3(1)(c) lays down that a company may be formed for any lawful purpose by one person, where the company to be formed is to be One Person Company that is to say, a private company. In other words, one person company is a kind of private company.

An One person company shall have a minimum of one director. Therefore, a One Person Company will be registered as a private company with one member and one director.

By virtue of section 3(2) of the Act, an OPC may be formed either as a company limited by shares or a company limited by guarantee; or an unlimited liability company.

Rule 3 of Companies (Incorporation) Rules, 2014 – One Person Company

- Only a natural person who is an Indian citizen and resident in India- (a) shall be eligible to incorporate a One Person Company; (b) shall be a nominee for the sole member of a One Person Company. Explanation-For the purposes of this rule, the term “resident in India” means a person who has stayed in India for a period of not less than one hundred and eighty two days during the immediately preceding one calendar year.

- A natural person shall not be a member of more than a One Person Company at any point of time and the said person shall not be a nominee of more than a One Person Company.

- Where a natural person, being member in One Person Company in accordance with this rule becomes a member in another such Company by virtue of his being a nominee in that One Person Company, such person shall meet the eligibility criteria specified in sub rule (2) within a period of one hundred and eighty days.

- No minor shall become member or nominee of the One Person Company or can hold share with beneficial interest.

- Such Company cannot be incorporated or converted into a company under section 8 of the Act.

- Such Company cannot carry out Non-Banking Financial Investment activities including investment in securities of anybody corporates.

- No such company can convert voluntarily into any kind of company unless two years have expired from the date of incorporation of One Person Company, except threshold limit (paid up share capital) is increased beyond fifty lakh rupees or its average annual turnover during the relevant period exceeds two crore rupees.